Payroll Software Online Payroll Services

How your team uses an online payroll system will vary depending on the size of your team, the expertise of your employees and the system you use. Most services come with excellent sales and customer service reps who can help you get set up and answer questions you have along the way. Wave is a unique fit for microbusinesses and solopreneurs who pay a small team heavy in contractors and part-timers, and frequently invoice clients or customers for online payment.

- By clicking “run payroll” from the dashboard, I completed a payroll run in just a few clicks.

- So, even if you’re relocated from your place of business, ADP’s payroll software lets you easily use a mobile device to pay your employees.

- Paychex solutions help with HR challenges faced by businesses with employees, such as payroll, employee support, compliance issues, etc.

- Her work has been featured by business brands such as Adobe, WorkFusion, AT&T, SEMRush, Fit Small Business, USA Today Blueprint, Content Marketing Institute, Towards Data Science and Business2Community.

- Adding helpful features such as the IT or workflow modules can get pricey.

The best payroll software for your company depends on your business size and needs. Top payroll services for small businesses include OnPay, Gusto and ADP RUN. Traditional companies offer customizable plans to fit your needs while platforms tailored for startups offer straightforward pricing and all-inclusive packages you can get up and running in minutes. Look for a service that offers essential features like accurate payroll processing, tax compliance and employee self-service options.

Do I Need a Payroll Service for My Small Business?

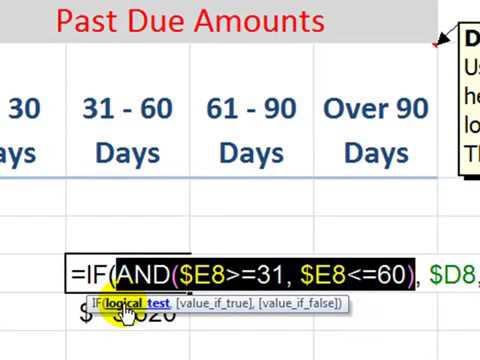

Some payroll services are part of comprehensive HR platforms that include not only pay and benefits but also employee development, education and coaching programs. For example, you will find a company directory on the upper right-hand corner of the software that includes a list of all employees. Simply click on a name to see all of their payroll information, such as their gross and net pay, deductions, pay period and preferred payment method.

A small business may only need basic features that save time and help them with tax compliance. Larger corporations, on the other hand, tend to look for more advanced solutions that can integrate payroll with other HR systems or have advanced reporting capabilities. ADP’s payroll software easily syncs with time and attendance solutions and other human resource programs. So, from one place, you can manage not just payroll, but also benefits, employee absences, 401(k) contributions, insurance premiums and more. Full-service setup, payroll, and tax filing online, plus, additional HR options. You’ll get access to Taxpay®, our automatic tax administration service, when you choose to process payroll with us.

QuickBooks Online Payroll works for small to midsize businesses—from accountants and financial experts to hospitality companies, construction companies, and truckers. Find everything you need from employee benefits bookkeeping articles to hiring and management tools. Faster, easier, more reliable HR and payroll solutions designed to help you focus on what matters. QuickBooks Payroll has what you need to stay compliant, from labor law posters to expert support. Comprehensive coverage for your business, property, and employees. To further evaluate your payroll needs, answer these ten questions about your business and its payroll system.

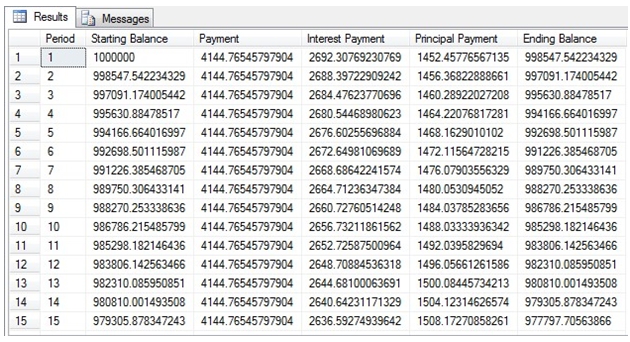

Payroll software costs vary depending on the number how to calculate monthly accumulated depreciation of people employed by the business, its individual needs and the provider’s price structure. An annual base price usually applies and there may be an additional fee for each payroll transaction. When weighing payroll software costs, it’s important to assess the level of support provided with the product and how well it can integrate with other programs. Of the many types of payroll software on the market today, some are easier to use than others.

What are the phases of the payroll management process?

To avoid violations, employers what is cost principle should contact their state labor departments for specific requirements. Through time sheets or time and attendance software, employers must accurately track the hours worked by non-exempt employees each workweek to correctly calculate pay. Time tracking isn’t as crucial for salaried employees because their gross pay is the product of their annual salary divided by the number of pay periods in the calendar year. However, some non-exempt employees may earn a salary, in which case, their hours must be tracked to ensure any overtime work is paid, as required by law. You can process payroll anywhere because ADP products are in the cloud.

Best All-in-One Payroll and HR Solution

Terms, conditions, pricing, special features, and service and support options subject to change without notice. Paychex solutions help with HR challenges faced by businesses with employees, such as payroll, employee support, compliance issues, etc. Most states require businesses to provide employees with statements that accompany their wages. For instance, some states require providing paper or electronic access, while others allow employees to opt in or out of receiving electronic pay slips. While state law will also dictate what specific information needs to be on the statement, generally, the rates of pay, hours worked, gross pay, net pay, and deductions must be displayed.

Employers must calculate and withhold federal, state and local taxes from employee wages. The exact amounts are based on current tax rates and each employee’s Form W-4, Employee’s Withholding Certificate and state or local withholding certificates. Some states, however, require employees to contribute to state unemployment, as well as disability and paid family leave programs through payroll deductions. All payments must be sent to government agencies by the specified deadlines. Greg Duffy deals with certified payroll to properly pay his employees. He’s now been a Paychex client for more than 30 years and said he’s amazed at how simple that part of his business has become.