Contribution Margin What Is It, Formula, Calculator

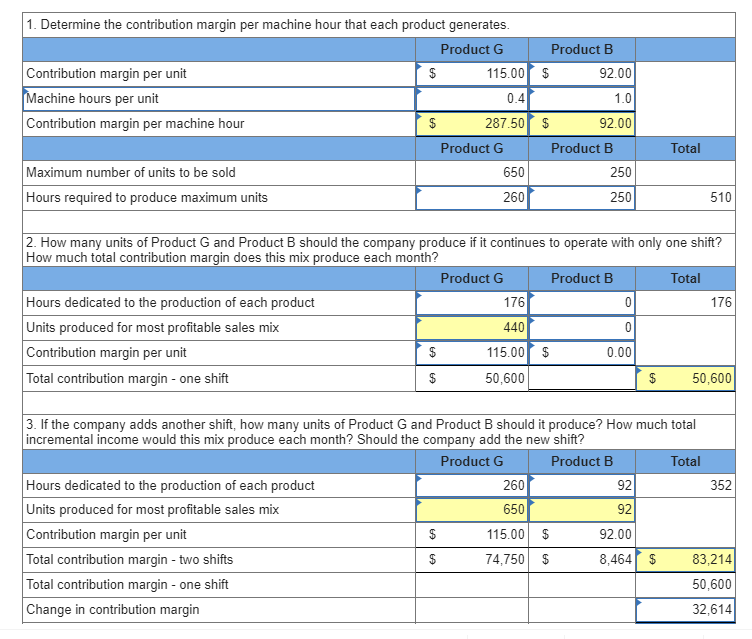

It represents the incremental money generated for each product/unit sold after deducting the variable portion of the firm’s costs. Knowing how to calculate the contribution margin is an invaluable skill for managers, as using it allows for the easy computation of break-evens and target income sales. This, in turn, can help people make better decisions regarding product & service pricing, product lines, and sales commissions or bonuses. Watch this video from Investopedia reviewing the concept of contribution margin to learn more. Keep in mind that contribution margin per sale first contributes to meeting fixed costs and then to profit.

- For a quick example to illustrate the concept, suppose there is an e-commerce retailer selling t-shirts online for $25.00 with variable costs of $10.00 per unit.

- The contribution margin is expressed as either a ratio or a percentage of the selling price, which indicates the portion of each dollar of sales that helps to cover your fixed costs and generate profit.

- Invest in the right tools and technology to automate your workflows, such as manufacturing software or barcode scanners.

- The contribution margin may also be expressed as a percentage of sales.

Fixed cost vs. variable cost

While there are plenty of profitability metrics—ranging from the gross margin down to the net profit margin—the contribution margin metric stands out for the analysis of a specific product or service. The contribution margin (CM) is the profit generated once variable costs have been deducted from revenue. Conceptually, the contribution margin ratio reveals essential information about a manager’s ability to control costs. The contribution margin may also be expressed as a percentage of sales. When the contribution margin is expressed as a percentage of sales, it is called the contribution margin ratio or profit-volume ratio (P/V ratio). Note that the total contribution of £180,000 is not the total profit made by the business.

Everything You Need To Master Financial Modeling

You’ll often turn to profit margin to determine the worth of your business. It’s an important metric that compares a company’s overall profit to its sales. However, if you want to know how much each product contributes to your bottom line after covering its variable costs, what you need is a contribution margin. It helps investors assess the potential of the company to earn profit and the part of the revenue earned that can help in covering the fixed cost of production.

Why is the contribution margin useful?

This cost of the machine represents a fixed cost (and not a variable cost) as its charges do not increase based on the units produced. Such fixed costs are not considered in the contribution margin calculations. The contribution margin is computed as the selling price per unit, minus the variable cost per unit. Also known as dollar contribution per unit, the measure indicates how a particular product contributes to the overall profit of the company. The difference between fixed and variable costs has to do with their correlation to the production levels of a company.

Contribution margin on income statement

Learn financial statement modeling, DCF, M&A, LBO, Comps and Excel shortcuts. For instance, in Year 0, we use the following formula to arrive at a contribution margin of $60.00 per unit. One common misconception pertains to the difference between the CM and the gross margin (GM). If the contribution margin is too low, the current price point may need to be reconsidered. In such cases, the price of the product should be adjusted for the offering to be economically viable.

The contribution margin tells us whether the unit, product line, department, or company is contributing to covering fixed costs. The contribution margin is important because it gives you a clear, quick picture of how much « bang for your buck » you’re getting on each sale. It offers insight into how your company’s products and sales fit into the bigger picture of your business. If the contribution margin for a particular product is low or negative, it’s a sign that the product isn’t helping your company make a profit and should be sold at a different price point or not at all.

It is important to note that this unit contribution margin can be calculated either in dollars or as a percentage. To demonstrate this principle, let’s consider the costs and revenues of Hicks Manufacturing, a small company that manufactures and sells birdbaths to specialty retailers. In this example, product A (toy slimes) has a higher sales revenue and volume of units sold but has a lower contribution margin.

The articles and research support materials available on this site are educational and are not intended to be investment or tax advice. All such information is provided solely for convenience purposes only and all users thereof should be guided accordingly. Finance Strategists has an advertising relationship with some of the companies included on this website. We may earn a commission when you click on a link or make a purchase through the links on our site. All of our content is based on objective analysis, and the opinions are our own. Variable costs tend to represent expenses such as materials, shipping, and marketing, Companies can reduce these costs by identifying alternatives, such as using cheaper materials or alternative shipping providers.

It includes the rent for your building, property taxes, the cost of buying machinery and other assets, and insurance costs. Whether you sell millions of your products or 10s of your products, these expenses remain the same. In short, profit margin gives you a general idea of how well a business is doing, while contribution how to find contribution per unit margin helps you pinpoint which products are the most profitable. Let’s take another contribution margin example and say that a firm’s fixed expenses are $100,000. Very low or negative contribution margin values indicate economically nonviable products whose manufacturing and sales eat up a large portion of the revenues.

All of these new trends result in changes in the composition of fixed and variable costs for a company and it is this composition that helps determine a company’s profit. Let’s examine how all three approaches convey the same financial performance, although represented somewhat differently. Variable costs are not typically reported on general purpose financial statements as a separate category. Thus, you will need to scan the income statement for variable costs and tally the list. Some companies do issue contribution margin income statements that split variable and fixed costs, but this isn’t common.