Average Payment Period Formula Example Calculation Explanation

The average payment period can help the management team see how efficient the company has been over the past year with such credit decisions. The challenges faced by businesses in maintaining adequate cash flow and keeping up with demand cannot be underestimated. These can be successfully managed and even overcome by applying efficient credit management strategies, optimizing the average payment period, and continuously benchmarking against industry best practices. Before you proceed with the actual calculation process, you must locate the accounts payable information, which is present on the balance sheet – beneath the current liabilities section.

Welcome to Accounting Education

The ACP shows the average number of days it takes for a company to collect payments from its credit sales. Finding the right balance between managing breads and maintaining strong supplier relationships is essential —understanding your DPO is key to achieving this. However, an imbalanced number can harm supplier relationships or result in missed early payment discounts. Some businesses may choose to extend their APP as a strategic finance move, helping them utilize their cash resources for other investment opportunities or operational needs. It becomes a concern only if the company struggles to honour its commitments in the long run. To conclude, the payment period accounts for a sensor that points how well a company can utilize its cash flow to cover short-term needs.

How to Improve DPO

- A solvency ratio helps a company determine its ability to continue business as usual in the long-term.

- A high average payment period may be bad for a company that is likely to lose customers if they are slow with paying their bills.

- Typical DPO values vary widely across different industry sectors and it is not worthwhile comparing these values across different sector companies.

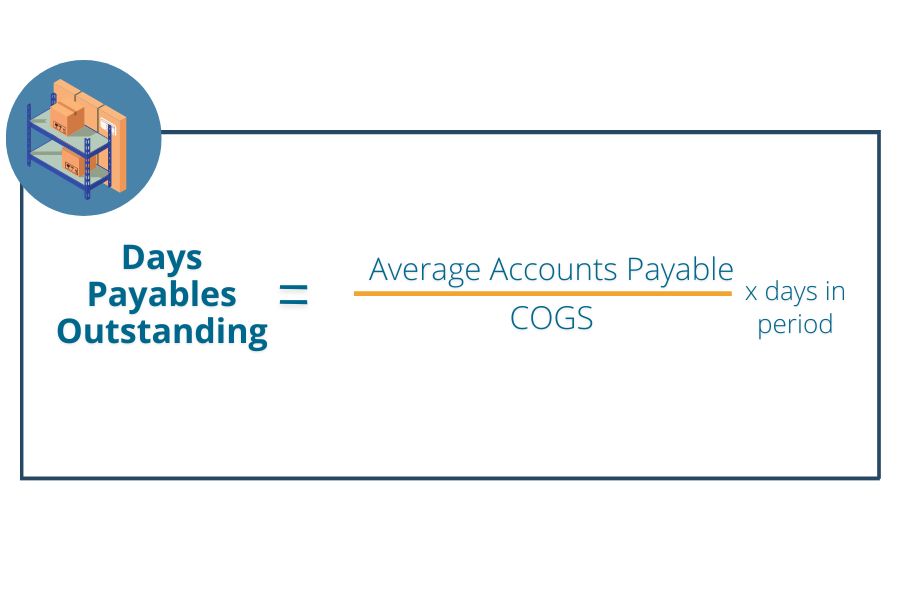

- The average payment period is calculated by dividing the average accounts payable by the product of total credit purchases and the total days in a year.

- However, excessively long payment periods may negatively impact the reputation of the company, hindering its ability to negotiate future credit terms.

Understanding the DPO reflects current AP workflows, showing where improvements should be made. For example, late payments can lead to costly fees and penalties and damage supplier relationships. Determining irs form 1040 where to improve efficiencies ensures timely payments and helps the organization save money. If the payment period of the business is higher, they are expected to raise a lower amount of finance.

📹 Dive into the World of Accounting Education!

He currently researches and teaches economic sociology and the social studies of finance at the Hebrew University in Jerusalem. Go a level deeper with us and investigate the potential impacts of climate change on investments like your retirement account. Company XYZ has beginning accounts payable of $123,000 and ending accounts payable of $136,000. This is an in-depth guide on how to calculate Average Payment Period with detailed interpretation, analysis, and example. My Accounting Course is a world-class educational resource developed by experts to simplify accounting, finance, & investment analysis topics, so students and professionals can learn and propel their careers. Speaking of improving your relationship with your supplier, learn more about how to strengthen it with effective strategies, especially for international trade.

This must be balanced against the risk of damaging relationships with suppliers or incurring additional costs like late payment fees. Although 48% of customers delay payments, well-structured payment terms can motivate them to clear their dues on time. Offering incentives for early payments and implementing masterful collection strategies can significantly enhance the performance ratio and, consequently, your average payment period. Prompt and consistent payment can prompt suppliers to consider extended credit terms, contributing towards a longer APP without damaging the business’s reputation or supplier relationships. Hence, APP management, while seemingly a simple concept, involves strategic planning and careful financial management. Additionally, a company may need to balance its outflow tenure with that of the inflow.

. Are the average payment period and average collection period the same?

Any changes that could occur to this number have to be evaluated in detail to determine the immediate effects on the cash flow. This concept is useful for determining how efficient the company is at clearing whatever short-term account obligations it may have. Typical DPO values vary widely across different industry sectors and it is not worthwhile comparing these values across different sector companies.

This can cause wrong decisions to be made which might have catastrophic consequences for the company in the short term. The reason that the company wants you to calculate the average payment period is that they want to be as lean as possible in its operations. These discounts are offered when bills are paid within 30 days since the payment terms are 10/30 net 90. It helps key stakeholders and decision-makers identify how quickly the company can pay off its credit purchases and liabilities.

StockMaster is here to help you understand investing and personal finance, so you can learn how to invest, start a business, and make money online. If the payment terms are set at 30 days, then 38 days is probably too long to settle payment and may potentially be causing some consternation to your suppliers. Calculate credit sales per day– The amount can be calculated by summing total credit purchases in a specific period and dividing by the number of days. The time lag between the credit purchase made and the actual date of payment is often used by customers who are in a strong position to negotiate. The management team will use this information to determine if paying off credit balances faster and receiving discounts might produce better results for the company.

Significant deviations from the industry norm could indicate potential operational issues or strategic differences. From a strategic viewpoint, a longer average payment period usually means that the company is able to use its suppliers’ money for a longer time, thereby conserving its own cash. However, excessively long payment periods may erode supplier goodwill or even result in disruptions to supply. The shorter the Average Payment Period, the quicker a company is in meeting its obligations, which generally signals sound financial health and effective cash flow management. Conversely, a longer APP might indicate potential liquidity issues or a strategic decision to delay payments for cash flow management. Also known as an important solvency ratio, the average payment period (APP) assesses how much time it takes for a business to pay its vendors, in the case of purchases made on credit.