Accounting Rate of Return Definition, Formula Calculate ARR

All such information is provided solely for convenience purposes only and all users thereof should be guided accordingly. The Accounting Rate of Return can be used to measure how well a project or investment does in terms of book profit. For example, say that an investor purchased a short-term bond, such as a US Treasury Bill, for $950 and redeemed it for its face value of $1000 at maturity. Get granular visibility into your accounting process to take full control all the way from transaction recording to financial reporting. This indicates that for every $1 invested in the equipment, the corporation can anticipate to earn a 20 cent yearly return relative to the initial expenditure.

How confident are you in your long term financial plan?

For example, if your business needs to decide whether to continue with a particular investment, whether it’s a project or an acquisition, an ARR calculation can help to determine whether going ahead is the right move. If you’re making a long-term investment in an asset or project, it’s important to keep a close eye on your plans and budgets. Accounting Rate of Return (ARR) is one of the top 10 free accounts receivable excel template download 2022 wps office academy best ways to calculate the potential profitability of an investment, making it an effective means of determining which capital asset or long-term project to invest in. Find out everything you need to know about the Accounting Rate of Return formula and how to calculate ARR, right here. The accounting rate of return percentage needs to be compared to a target set by the organisation.

Get Your Questions Answered and Book a Free Call if Necessary

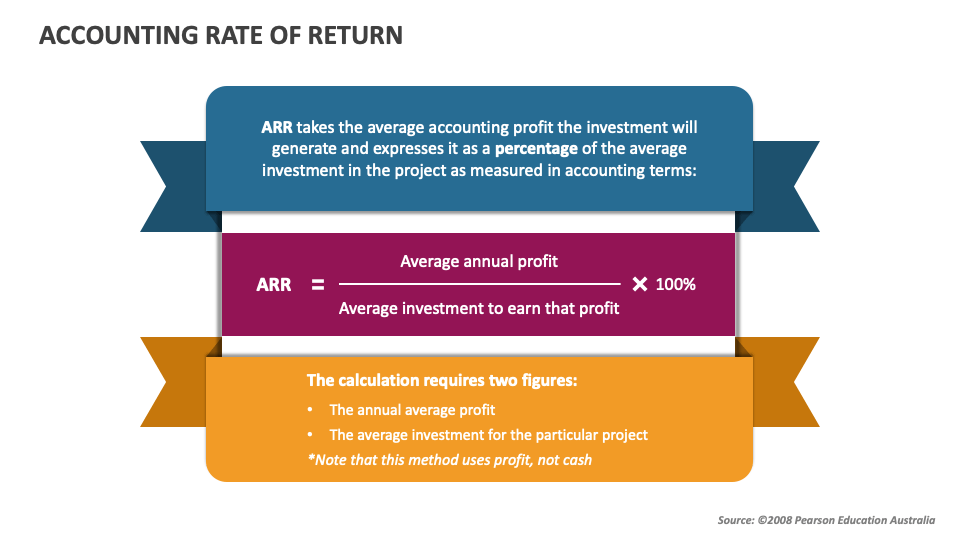

If you have already studied other capital budgeting methods (net present value method, internal rate of return method and payback method), you may have noticed that all these methods focus on cash flows. But accounting rate of return (ARR) method uses expected net operating income to be generated by the investment proposal rather than focusing on cash flows to evaluate an investment proposal. Kings & Queens started a new project where they expect incremental annual revenue of 50,000 for the next ten years, and the estimated incremental cost for earning that revenue is 20,000.

Accounting rate of return method

Accounting Rates of Return are one of the most common tools used to determine an investment’s profitability. It can be used in many industries and businesses, including non-profits and governmental agencies. Calculate the denominator Look in the question to see which definition of investment is to be used. If the question does not give the information, then use the average investment method, and state this in your answer. The company may accept a new investment if its ARR higher than a certain level, usually known as the hurdle rate which already approved by top management and shareholders. It aims to ensure that new projects will increase shareholders’ wealth for sustainable growth.

What Is the Difference Between ARR and Internal Rate of Return (IRR)?

For a project to have a good ARR, then it must be greater than or equal to the required rate of return. This team of experts helps Finance Strategists maintain the highest level of accuracy and professionalism possible. The articles and research support materials available on this site are educational and are not intended to be investment or tax advice.

- In this blog, we delve into the intricacies of ARR using examples, understand the key components of the ARR formula, investigate its pros and cons, and highlight its importance in financial decision-making.

- 11 Financial may only transact business in those states in which it is registered, or qualifies for an exemption or exclusion from registration requirements.

- At Finance Strategists, we partner with financial experts to ensure the accuracy of our financial content.

- All of our content is based on objective analysis, and the opinions are our own.

- HighRadius provides cutting-edge solutions that enable finance professionals to streamline corporate operations, reduce risks, and generate long-term growth.

Limitations of Accounting Rate of Return

To find this, the profit for the whole project needs to be calculated, which is then divided by the number of years for which the project is running (in this case five years). It is a useful tool for evaluating financial performance, as well as personal finance. It also allows managers and investors to calculate the potential profitability of a project or asset. It is a very handy decision-making tool due to the fact that it is so easy to use for financial planning.

Finance Strategists has an advertising relationship with some of the companies included on this website. We may earn a commission when you click on a link or make a purchase through the links on our site. All of our content is based on objective analysis, and the opinions are our own. For example, you invest 1,000 dollars for a big company and 20 days later you get 300 dollars as revenue.

Accounting rate of return is the estimated accounting profit that the company makes from investment or the assets. It is the percentage of average annual profit over the initial investment cost. This method is very useful for project evaluation and decision making while the fund is limited.