What Are Chart of Accounts? How It Works, Setting up & Pros

These should have their separate records but also be organized into one main chart of accounts. The number of accounts you organize in your general ledger will vary based on the size of your company. The smaller your operations, the smaller your chart of accounts will likely be. Asset, liability and equity accounts are generally listed first in a COA. These are used to generate the balance sheet, which conveys the business’s financial health at that point in time and whether or not it owes money.

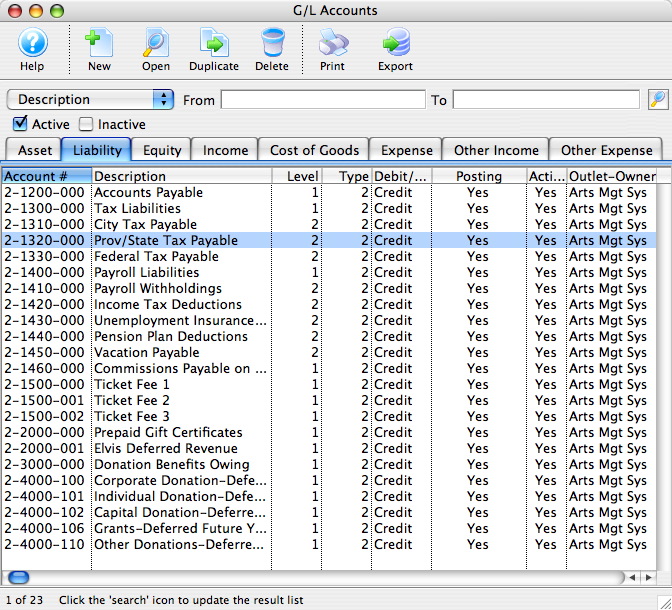

Create sub-accounts

Generally, account numbers consist of digits that represent the various account categories and subcategories. A chart of accounts (COA) is an index of all of the financial accounts in a company’s general ledger. In short, it is an organizational tool that lists by category and line item all of the financial transactions that a company conducted during a specific accounting period. The chart of accounts is important because it allows you to organize your company’s financial data and distill it into clear and logical categories. It helps to categorize all transactions, working as a simple, at-a-glance reference point. As your business grows, so will your need for accurate, fast, and legible reporting.

Successfully Transitioning to a Structured CoA

In a chart of accounts, assets are usually classified into current or non-current categories. Current assets are those that can be converted into cash or used up within one year, such as cash and inventory. Non-current assets are long-term resources, such as property, plant, and equipment. This classification helps businesses assess their liquidity and long-term financial health. The first three are assets, liabilities, and equity, which flow into the balance sheet. The remaining two are income or revenue and expenses, which flow into the income statement.

Digit Account Code Structure Example

- More complex entities may have longer account codes to accommodate the reporting needs of the entity.

- It shows peaks and valleys in your income, how much cash flow is at your disposal, and how long it should last you given your average monthly business expenses.

- Here’s an example with the first 10 representing assets and the second 10 representing cash.

- Every time you add or remove an account from your business, it’s important to record it in your books and your chart of accounts (COA) helps you do that.

- At the end of the year, review all of your accounts and see if there’s an opportunity for consolidation.

The main level includes broad categories like assets, liabilities, equity, revenue, and expenses. Subsequent levels break these down into more detailed accounts, providing granularity for better tracking and reporting. The exact number of levels depends on the complexity and needs of the business, and sometimes an opportunity for consolidation may simplify the structure. At the end of the year, a review of these accounts may indicate if fewer levels would be advantageous. A version of this article was first published on Fundera, a subsidiary of NerdWallet, highlighting the evolving strategies in accounting practices.

Add financial statements

Normally for ease of use the groupings follow the accounts used in a typical balance sheet layout followed by those used in a typical income statement layout. A chart of accounts (COA) is a structured list of an organization’s financial accounts used to difference between horizontal and vertical analysis with comparison chart categorize and record financial transactions. It serves as the backbone of an accounting system, providing a framework for organizing financial data in a logical manner. The COA is tailored to an organization’s needs and can vary widely in complexity.

Over-Complicating Your CoA

Financing through long-term liabilities allows a business to manage its immediate cash flow needs while planning for its long-term strategy. As an example, here’s how you might consider organizing your various operating revenue accounts. That doesn’t mean recording every single detail about every single transaction. You don’t need a separate account for every product you sell, and you don’t need a separate account for each utility. By incorporating these advanced COA concepts, an organization can streamline its financial management processes and optimize its performance while remaining compliant with regulatory and industry standards.

If you subtract the money taken out of the business by the owner and money owed to others, you’ll be left with the owner’s equity amount. Liabilities in accounting are what a company owes or has borrowed, usually a sum of money. They can include a future service owed to others or a previous transaction that created an unsettled obligation. With online accounting software, you can organize and track your balance sheet accounts. No matter if you’re an entrepreneur starting a business or an owner looking to streamline your practices, accounting software can help you get the job done.

For the past 52 years, Harold Averkamp (CPA, MBA) hasworked as an accounting supervisor, manager, consultant, university instructor, and innovator in teaching accounting online. For the past 52 years, Harold Averkamp (CPA, MBA) has worked as an accounting supervisor, manager, consultant, university instructor, and innovator in teaching accounting online. A financial professional will offer guidance based on the information provided and offer a no-obligation call to better understand your situation. The articles and research support materials available on this site are educational and are not intended to be investment or tax advice. All such information is provided solely for convenience purposes only and all users thereof should be guided accordingly.

By doing so, you can easily understand what products or services are generating the most revenue in your business. If you create too many categories in your chart of account, you can make your entire financial reports difficult to read and analyze. The main types of accounts are assets, liabilities, revenue, expenses, and equity.