How to Record Dividends in a Journal Entry

This typically happens each quarter for U.S.-based firms, when the company declares a dividend amount at its own discretion. Accountants must make a series of two journal entries to record the payout of these dividends each quarter. Companies use stock dividends to convert their retained earnings to contributed capital.

What is the Definition of Dividends Payable?

A financial professional will offer guidance based on the information provided and offer a no-obligation call to better understand your situation. Someone on our team will connect you with a financial professional in our cost recovery method of revenue recognition network holding the correct designation and expertise. Our team of reviewers are established professionals with decades of experience in areas of personal finance and hold many advanced degrees and certifications.

So Many Dividends

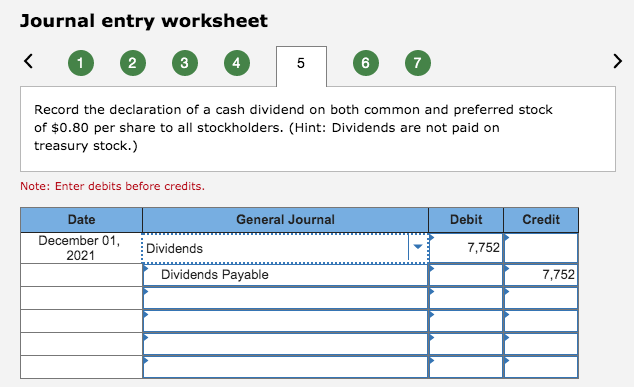

Though, the term “cash dividends” is easier to distinguish itself from the stock dividends account which is a completely different type of dividend. Credit The credit entry to dividends payable represents a balance sheet liability. At the date of declaration, the business now has a liability to the shareholders to pay them the dividend at a later date. Occasionally, a firm will issue a dividend in which the payment is in an asset other than cash. Non-cash dividends, which are called property dividends, are more likely to occur in private corporations than in publicly held ones. Later, on the date when the previously declared dividend is actually distributed in cash to shareholders, the payables account would be debited whereas the cash account is credited.

Accounting for Cash Dividends When Only Common Stock Is Issued

The credit entry to dividends payable represents a balance sheet liability. At the date of declaration, the business now has a liability to the shareholders to be settled at a later date. A stock dividend distributes shares so that after the distribution, all stockholders have the exact same percentage of ownership that they held prior to the dividend. There are two types of stock dividends—small stock dividends and large stock dividends.

However, recording dividends should be simple (especially if you have your bookkeeper do it). Whether you follow GAAP or use cash-basis accounting, you can make sure your financial reports are accurate with proper dividend reporting. The Dividends Payable account records the amount your company owes to its shareholders. In the general ledger hierarchy, it usually nestles under current liabilities. The Board’s declaration includes the date a shareholder must own stock to qualify for the payment along with the date the payments will be issued. GAAP is telling everyone that once dividends are declared, instantly the money is owed.

Great! The Financial Professional Will Get Back To You Soon.

The accounting for large stock dividends differs from that of small stock dividends because a large dividend impacts the stock’s market value per share. While there may be a subsequent change in the market price of the stock after a small dividend, it is not as abrupt as that with a large dividend. When investors buy shares of stock in a company, they effectively become part-owners of the firm. In return, the company may choose to distribute some of its earnings to these owners, or shareholders, in the form of dividends.

From a practical perspective, shareholders return the old shares and receive two shares for each share they previously owned. The new shares have half the par value of the original shares, but now the shareholder owns twice as many. If a 5-for-1 split occurs, shareholders receive 5 new shares for each of the original shares they owned, and the new par value results in one-fifth of the original par value per share. The third date, the Date of Payment, signifies the date of the actual dividend payments to shareholders and triggers the second journal entry.

Just before the split, the company has 60,000 shares of common stock outstanding, and its stock was selling at $24 per share. The split causes the number of shares outstanding to increase by four times to 240,000 shares (4 × 60,000), and the par value to decline to one-fourth of its original value, to $0.125 per share ($0.50 ÷ 4). A small stock dividend occurs when a stock dividend distribution is less than 25% of the total outstanding shares based on the shares outstanding prior to the dividend distribution. To illustrate, assume that Duratech Corporation has 60,000 shares of $0.50 par value common stock outstanding at the end of its second year of operations. Duratech’s board of directors declares a 5% stock dividend on the last day of the year, and the market value of each share of stock on the same day was $9. Figure 5.73 shows the stockholders’ equity section of Duratech’s balance sheet just prior to the stock declaration.

To illustrate how these three dates relate to an actual situation, assume the board of directors of the Allen Corporation declared a cash dividend on May 5, (date of declaration). The cash dividend declared is $1.25 per share to stockholders of record on July 1, (date of record), payable on July 10, (date of payment). Because financial transactions occur on both the date of declaration (a liability is incurred) and on the date of payment (cash is paid), journal entries record the transactions on both of these dates. The Dividends Payable account appears as a current liability on the balance sheet.

- The first date is when the firm declares the dividend publicly, called the Date of Declaration, which triggers the first journal entry to move the dividend money into a dividends payable account.

- The credit entry to dividends payable represents a balance sheet liability.

- To see the effects on the balance sheet, it is helpful to compare the stockholders’ equity section of the balance sheet before and after the small stock dividend.

- Companies use stock dividends to convert their retained earnings to contributed capital.

- At the same time as the dividend is declared, the business will have decided on the date the dividend will be paid, the dividend payment date.

The shareholders who own the stock on the record date will receive the dividend. Although, the duration between dividend declared and paid is usually not long, it is still important to make the two separate journal entries. This is especially so when the two dates are in the different account period. A dividend payment includes the amount of cash or other investments distributed to shareholders. There are a number of reasons that a corporation may issue a stock dividend rather than a cash dividend.