Trust Accounting: Quick Guide for Law Firms

This approach can simplify the management of smaller amounts or when transactions are frequent but requires meticulous record-keeping to accurately track each client’s balance. Separate trust accounts, on the other hand, are established for individual clients, offering a clear, straightforward management of larger sums or when funds are held for extended periods. Even if the money is intended to eventually pay https://www.bookstime.com/ you for legal services, it is not yours until you’ve actually performed the services. Attorneys might be tempted to ‘borrow’ money from the trust account during cash flow problems, thinking it harmless since the money will be theirs eventually.

A Guide to Legal Trust Accounting in QuickBooks and Clio for Lawyers

Trust accounting refers to the practice of keeping separate track of client funds given in trust and a law firm’s operating funds. Legal payments software can also help keep attorney and client funds easily separated. These types of tools help you seamlessly manage physical and electronic client payments between your firm’s trust account and operating account while ensuring compliance.

How to Simplify IOLTA Trust Accounting – With LeanLaw

To effectively manage legal accounting for law firms, it’s wise to start with a foundation that works for all aspects of running your firm. Every law firm has a responsibility to stay compliant with ethics regulations, and your firm is no exception. Ethics rules vary in each jurisdiction, but there are definitely some basics when it comes to accounting for law firms. While you’ve spent years honing your skills to become a great lawyer, you didn’t learn about accounting or bookkeeping for attorneys at law school. You are responsible for reading, understanding, and agreeing to the National Law Review’s (NLR’s) and the National Law Forum LLC’s Terms of Use and Privacy Policy before using the National Law Review website. The National Law Review is a free-to-use, no-log-in database of legal and business articles.

Trust Accounting 101 for Law Firms

There is trust accounting for lawyers a $400,000 maximum limit, per law client loss, on awards from the Fund, fixed by regulation of the Trustees. In these efforts, the Lawyers’ Fund serves as a helpmate to the courts of New York in shielding the integrity of the justice system and the honor and reputation of the lawyers who serve as its officers. Tabs3 Trust Accounting includes a Positive Pay Export program, which offers greater security in a more streamlined workflow. Directly export approved checks and upload them to your financial institution to support the Positive Pay fraud prevention program. It’s unclear whether or not charging such an “intake fee” doesn’t count as part of this limit.

- Whether it means using legal accounting software to simplify and automate your accounting, hiring a professional legal accountant, or both—don’t be afraid to delegate when you need to.

- Each state has its own set of rules and guidelines for trust accounting, including how accounts should be set up, managed, and audited.

- Managing an IOLTA account requires understanding specific regulations and guidelines, which vary by state.

- You should be able to check your firm’s financial records and progress at any time, so you can make informed decisions for your clients and your firm.

- It is your law firm’s responsibility to protect clients’ funds from hackers and identity thieves.

- Attorneys might be tempted to ‘borrow’ money from the trust account during cash flow problems, thinking it harmless since the money will be theirs eventually.

- On the flip side, law firm trust accounting can be the key to a profitable law practice.

- With the right tools, trust accounting can become a less daunting responsibility.

- Lawyers may charge administrative fees for the time and work involved in handling escrow funds entrusted to them and doing the required record-keeping for those funds.

- The importance of diligence in trust accounting for lawyers cannot be overstated.

- Without the proper business bank accounts, you risk inaccurate bookkeeping, messy records, and potential compliance violations regarding trust funds.

In some states, multiple forms of proof that trust bank accounts are in balance may be required. Tabs3 Trust Accounting software provides this proof via the Three-Way Reconciliation Report. Selecting the right solution to manage your firm’s operating and client trust accounts will help you focus on serving your clients.

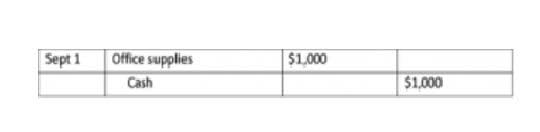

The trust accounting process

And when the law staff uses software that delights them, it will boost morale and increase professional responsibility. The lawyers and law staff work in LeanLaw while the accounting folks work in QuickBooks. Poor accounting practices, such as struggling to track billable hours or sending out invoices late, can lead to money leakage. This is a list of all your firm’s financial accounts, giving you a framework for where to record bookkeeping every transaction.