Reconciliation in Accounting: Everything You Need to Know

Similarly, if there are deposits appearing in the bank statement but are not in the cash book, add the entries to the cash book balance. Incorporating these strategies into your reconciliation process not only simplifies the task but also enhances the accuracy and efficiency of your financial management. Integration with accounting software like NetSuite, QuickBooks, Xero, or Sage, especially when paired with Ramp, can be a significant step toward streamlining your financial operations.

In essence, reconciliation acts as a month-end internal control, making sure your sets of records are error-free. It is a general practice for businesses to create their balance sheet at the end of the financial year, as it denotes the state of finances for that period. However, you need to record financial transactions throughout the year in the general ledger to be able to put together the balance sheet. Account reconciliation is an important accounting process as the entries in the general ledger may not always be accurate. For instance, when you receive a check from a customer, you may have recorded it as paid.

How Precision Neuroscience streamlined systems and slashed data entry with Ramp

Ready to learn how easy it is to conduct trust reconciliation with Clio? Clio’s legal trust management software, and Clio Accounting both provide lawyers with the ability to conduct trust account reconciliation–helping to keep your firm compliant and your client’s funds secure. The first step is to compare transactions in the internal register and the bank account to see if the payment and deposit transactions match in both records. Identify any transactions in the bank statement that are not backed up by any evidence. As CEO and Co-Founder, Mike leads FloQast’s corporate vision, strategy and execution.

Reconcile to Account Activity

- In a general sense, it demonstrates that balancing the books gets taken seriously.

- Another possibility is that the difference is caused by the fraudulent manipulation of accounting records.

- Then you remember the check you wrote to a vendor last month for $7,000.

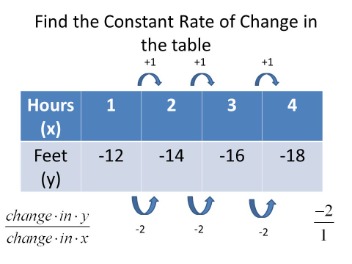

- Adding to the challenge, sometimes an entry in the general ledger may correspond to two or more entries in a bank statement, or vice versa.

- Reconciling these accounts is usually a simple matter of making sure that the balance in the relevant subledger or schedule matches the balance in the general ledger.

AutoRec leverages AI to reconcile transactions, whether those are one-to-one, one-to-many, or many-to-many. Unlike other reconciliation systems, AutoRec doesn’t require users to create or maintain rules. Plus, you can set accuracy thresholds to determine whether transactions need to match to the penny, or if being off by say 5% is close enough. Fortunately, today’s accountants have the advantage of automation and reconciliation tools like account reconciliation software that can make short work of the time-consuming chore of transaction matching. Most accounting systems and ERPs have built-in modules that can import bank transactions and compare them to the transactions in the system.

Business-specific reconciliations are performed within a specific business unit, such as stock inventory or expense reconciliation. This helps to ensure that the financial records of that unit are accurate and up-to-date. Reconciliations are usually performed at the end of an accounting period, such as during the month-end close process, to ensure that all transactions are correctly verified and the closing statements are accurate. As a result, the accounting industry has sought ways to automate a previously strenuous manual process. The pressure of SOX balance sheet template for your business is coupled with the perennial need to mitigate erroneous reconciliation in the process.

This type of reconciliation involves reconciling statements and transactions to ensure that all business units are on the same page financially. Vendor reconciliations involve comparing the statements provided by vendors or suppliers with the business’s accounts payable ledger. This helps ensure that the company pays vendors and suppliers accurately and on time. Once you have access to all the necessary records, you need to reconcile, or compare, the internal trust account’s ledger to individual client ledgers. In single-entry bookkeeping, every transaction is recorded just once rather than twice, as in double-entry bookkeeping, as either income or an expense. Single-entry bookkeeping is less complicated than double-entry and may be adequate for smaller businesses.

For adjusted net debt definition law firms, for example, one key type of business reconciliation is three-way reconciliation for trust accounts. Banks and retailers can make errors when counting money and issuing cash to customers as change. Variances between expected and actual amounts are called « cash-over-short. » This variance account is kept and reconciled as part of the company’s income statement. A company may issue a check and record the transaction as a cash deduction in the cash register, but it may take some time before the check is presented to the bank.

Investigate discrepancies

These processes demonstrate a company’s focus on accuracy and thoroughness. This is true for both those within a company and those looking in from the outside. Parent companies use this to bring together all the accounts and ledgers from the subsidiaries they may have.

And generating financial reports in Clio Accounting is a breeze, making your life, 6 e-commerce financing methods to fuel online growth and your accountant’s life that much easier. The equipment is used to complete ABC’s first lawn-care project worth $500. Using a double-entry accounting system, as shown below, ABC credits cash for $2,000 and debits assets, which is the equipment, by the same amount. For the first job, ABC credits $500 in revenue and debits the same amount for accounts receivable. Reconciliation is an accounting procedure that compares two sets of records to check that the figures are correct and in agreement and confirms that accounts in a general ledger are consistent and complete.

Timing differences occur when the activity that is captured in the general ledger is not present in the supporting data or vice versa due to a difference in the timing in which the transaction is reported. Reconciliation for prepaid assets checks the balances for different types of prepaid assets, factoring in transactions like additions and amortization. Prepaid assets, such as prepaid insurance, are gradually recognized as expenses over time, aligning with the general ledger. Account reconciliations are an essential part of financial management in any business. These reconciliations can be performed in several ways, depending on the context. To implement effective reconciliation processes, you need to create and document the exact procedures that staff and lawyers should follow.